It was not a great month for new vehicle sales as January unfolded to show a 3,8% decline compared to January 2023 and maintained a five-month trend of declining sales but expectations are it will pick up from the middle of the year should inflation and interest rates be contained.

Blamed on the lingering effects of cost-of-living increases, dampened consumer and business confidence combined with the country’s port challenges and persistent load shedding, Mikel Mabasa, naamsa CEO says aggregate domestic new vehicle sales in January 2024, were 41,636 units, reflecting a decline of 1 658 units.

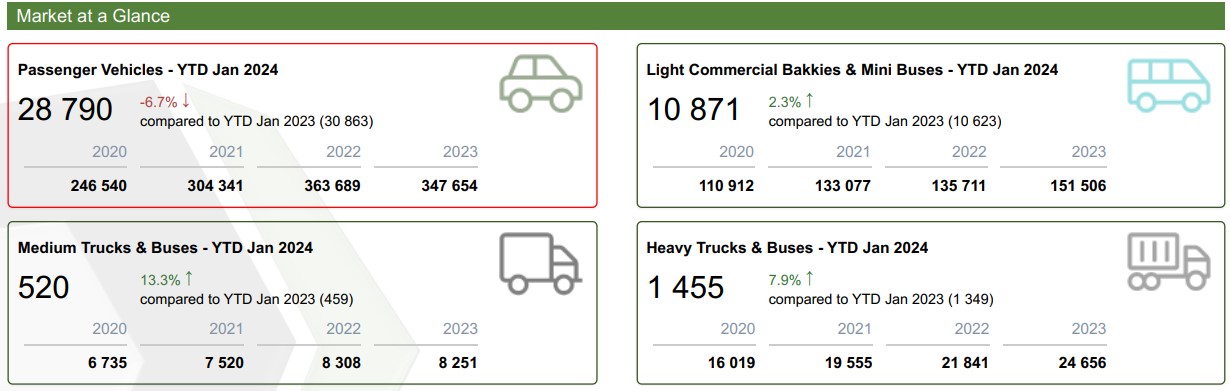

The January 2024 new passenger car market at 2 ,790 units egistered a decline of 2 073 cars, or a loss of 6,7%, compared to January 2023 - sales supported by car rental companies that accounted for15,0% of the new passenger vehicles sales.

Domestic sales of new light commercial vehicles, bakkies and mini-buses recorded an increase of 248 units, or a gain of 2,3%, while the medium commercial vehicle segment reflected an increase of 61 units, or a gain of 13,3% and the heavy truck and bus segments rose 7,9%.

Domestic sales of new light commercial vehicles, bakkies and mini-buses recorded an increase of 248 units, or a gain of 2,3%, while the medium commercial vehicle segment reflected an increase of 61 units, or a gain of 13,3% and the heavy truck and bus segments rose 7,9%.

“The weak performance of the new vehicle market in January 2024 remained intricately linked to the major economic headwinds that shaped the market’s performance in 2023, including highly indebted consumers, high interest rates, high food and fuel inflation, load shedding, and port backlogs and delays,” says Mabasa.

“South Africa’s economic growth outlook for 2024, at 1,2%, although stronger than in 2023, remains a key challenge for the new vehicle market going forward in view of the close correlation between new vehicle sales and the GDP growth rate. The year is also marked by elections, not just in South Africa but also in other major markets, introducing an element of economic uncertainty.

“South Africa’s economic growth outlook for 2024, at 1,2%, although stronger than in 2023, remains a key challenge for the new vehicle market going forward in view of the close correlation between new vehicle sales and the GDP growth rate. The year is also marked by elections, not just in South Africa but also in other major markets, introducing an element of economic uncertainty.

“A start of an interest rate cutting cycle, likely to commence during the second half of the year but preferably earlier, accompanied by easing core and food inflation, and improvements in the country’s energy and logistics infrastructure could provide a much-needed relief for consumers and subsequently stir up some momentum in the new vehicle market.

“Encouragingly, the Absa Purchasing Managers’ Index (PMI) relating to expected business conditions in six months’ time, despite the current economic woes, rose as respondents’ expectations turned more optimistic relative to current conditions.

Looking for your perfect Polo - click here and be amazed

“Following a record export performance in 2023, vehicle exports slightly declined year-on-year in January 2024. Several global externalities remain persistent, creating an uncertain backdrop for the year ahead, including sluggish global growth, a bullish inflationary environment and increased geo-political tensions. The global economy is expected to remain weak in 2024, but inflation is easing and interest rate cuts in major markets may be on the cards in the second half of the year, which would support the South African automotive industry’s export performance.”

He added, naamsa is looking forward to the new energy vehicle (NEV) regulatory framework details to be announced in the 2024 National Budget Speech on February 21 by the Minister of Finance, believing it would provide a much-needed injection of confidence for the South African automotive industry to accelerate its inevitable transition towards electric vehicle and associated component production and in stimulating demand for these new technology vehicles.

"It was generally predicted that the first half of 2024 would see little growth in the overall market after declines in each of the last five months of 2023," says Brandon Cohen, chairperson of the National Automobile Dealers' Association (NADA).

"It seems the dreaded 'Januworry' has taken effect with a further decline in consumer affordability due to the cost of living increases and the political climate uncertainty of an election year. Even the fact that the vehicle rental industry bought 11,5% of the total vehicles sold in January could not prevent another month of decline." .

The passenger car market fell by 6.7%, while light commercial vehicles were up by 2.3%, medium truck sales rose 13.3% off a low base, and the heavy truck and bus market grew 7.9% when compared with January 2023. Exports were disappointing, with the January total of 20,242 vehicles being 2.1% down on the figure for January 2023.Lebo Gaoaketse, head of Marketing and Communication at WesBank warned economic headwinds remain a very real concern for household income and the motor industry at large.

“The Reserve Bank’s decision to hold interest rates in January will hopefully provide some stimulus to market activity.”

However, WesBank expects numerous opportunities to exist from efforts to stimulate demand in the market.

“Banks may increase their risk appetite with lower quoted rates on deals to capture market share,” says Gaoaketse. “Brands and dealers will also be hungry to convert sales, offering enticing incentives that may provide an opportunity for the market to remain buoyant.”

Colin Windell

proudly CHANGECARS

With affordability a key issue, pre-owned beauties may be your route to go - look here